Question on SHM

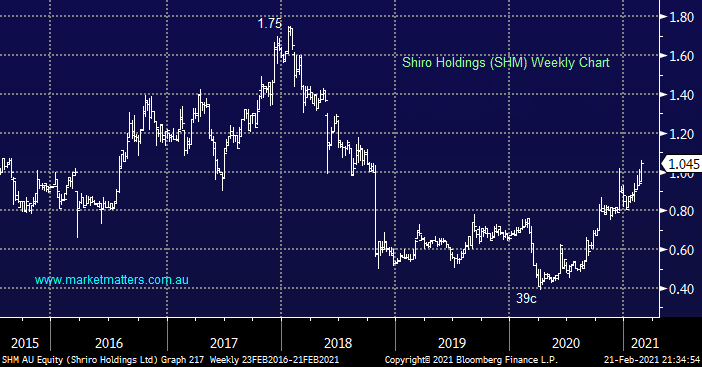

Hi James and Team Thanks for your ongoing commentary - very helpful Just looking for a view on a small cap , SHM It receives little coverage and research but it’s business model is a little like Breville It looks quite cheap to me Any commentary that you are able to provide on a fundamental or technical view would be appreciated Thanks Cheers David Payton