Question on banks

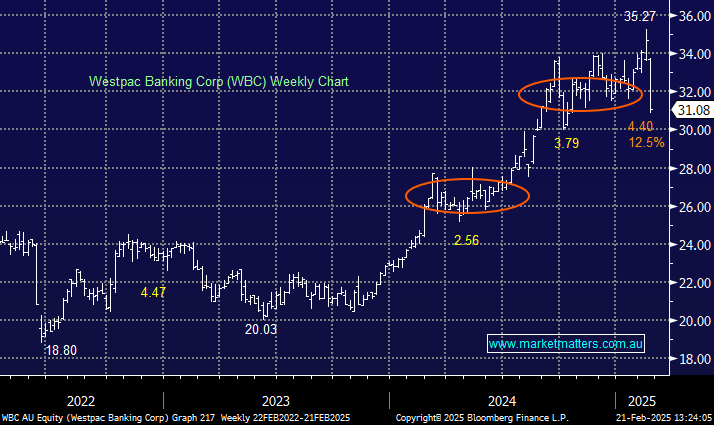

Hi Shawn, In a recent report you say you like WBC (because of growth) over CBA. As you know CBA has been holding it's price better than the other banks. Yet, it is overpriced as are all Australian Big 4 banks. I have been contemplating selling some CBA and buying a bank that has had a greater % fall in price than CBA. Of course no one knows how far the banks will fall and they certainly won't fall equally by %. As you recommended WBC in your report around $31; it would appear you think that is as far as you think it will drop or is it that you think that all the 4 big banks will drop but WBC is LIKELY to be the least affected. I already have too many bank shares and don't want any more, but, I am not adverse in changing the mix. In short, I guess I am asking you to rate the big 4 banks according to PROBABLE respective growth possibilities in the short to medium term. I am NOT asking about a specific bank only general information. Thank you for the great work you and all the team do. I would like to commend Vanessa on the EXCELLENT assistance she gave me today with a computer glitch I had. You have a great company and it is not just the stock analysts who make it great. Paul