Hi Debbie,

Obviously 2 very different companies here hence I’ve looked at them individually in this environment of multiple takeover bids which ultimately results in relatively few deals making it over the line to completion :

Mincor (MCR) $1.52 – Andrew “Twiggy” Forrest’s Wyloo has made a $760mn takeover bid for BHP nickel supplier MCR at $1.40, the stocks trading over 9% above his offer which is testament to the markets confidence that this deal will go ahead while a higher bid is a strong possibility.

Similar to the markets view, we believe MCR will be taken over in 2023 but the risk/reward is not exciting to pay a 10% premium to Twiggys bid even though BHP might again lock horns with Mr Forrest. If we held, we would continue to hold.

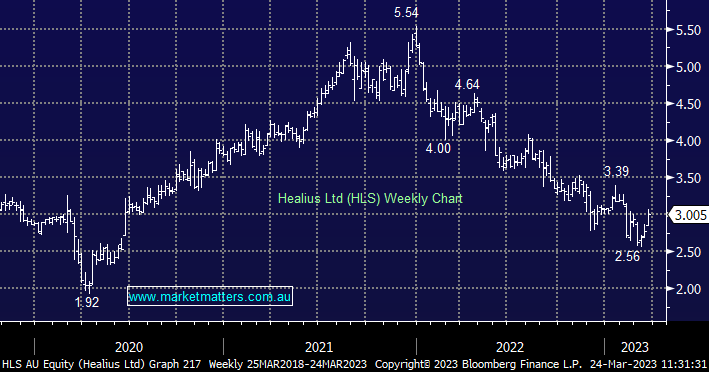

Healius (HLS) $2.93 – Australian Clinical Laboratries (ACL) has made a hostile takeover bid for HLS but most people believe it will fail under the combined pressures of both price and the competition watchdog front. The all script bid only comes in at $2.68 hence again the stock is trading above the bid as HLS again looks “in play” but we think this particular bid will probably ultimately fail.