Hi Alain,

It more shows how subjective analysis can be, and the varying inputs that go into a model to derive an earnings estimate, and then what multiple of those earnings should be applied. i.e. should the stock be on 10x earnings, or 15x earnings – there is not one rule that says this company must trade on a PE of x.

In all industries, big and small, there are good and bad plus of course some are improving and vice versa – hence we do pay heed to some analysts more than others and you will often see us write something along the lines of “well regarded analyst..”Analysts do get ranked and we can see these rankings on any stock, and pay some attention to this.

At MM we are looking at more than analysts valuations, analysts can be way too analytical and rigid in their assesments, often unable to admit when they’re wrong until after the horse has bolted – the damage has already been done! We pay a lot of attention to insights from the company and others around incremental trends or potential structural shifts for companies &/or their industries, and for large companies in particuar, how the macro-economic environment could help or hinder them, plus of course, price action (charts) also feed into our assesment.

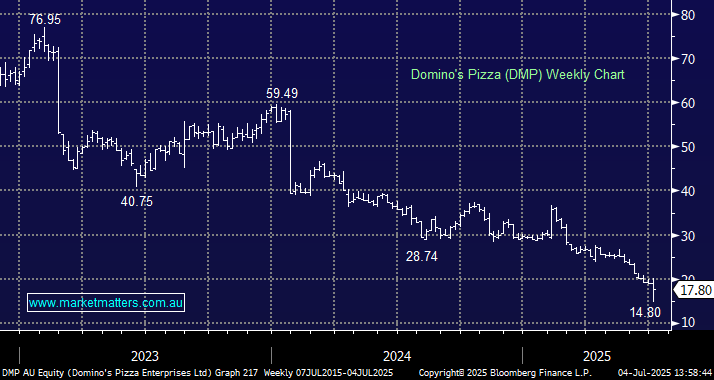

- In the case of DMP, we’ve been consistently negative, never understanding why the franchisees would consider buying a DMP business, the numbers are just not good, with super think margins leaving them vulnerable to changes in things like input costs (food) and labour costs – sometimes getting it right can be as simple as that.

RE the brokers you highlight, Jefferies have updated their numbers and kept $42 PT, Goldmans have not yet updated their view (date of last release was 13th June).