Hi Robert,

A big question hence we will keep it simple and look over the last two years:

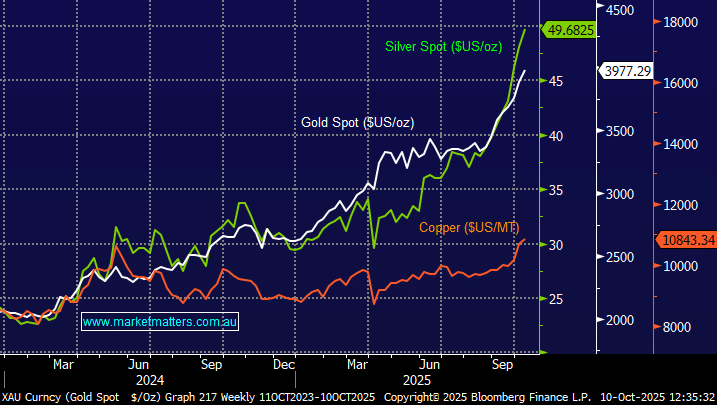

- Commodities: Gold +93%, Silver +109%, and Copper +28%.

- Stocks: Evolution (EVN) +180%, Northern Star (NST) +74%, and Sandfire Resources (SFR) +123%.

NB Unfortunately, there are no major silver stocks traded on the ASX.

In terms of gold stocks, we chose two of the largest, but it’s been a great time for virtually all precious metal miners. A couple of points of note here:

- Sandfire (SFR) and other global copper stocks, who investors can get exposure to in the ETF WIRE, have significantly outperformed the industrial metal.

- Gold stocks have generally outperformed the precious metal but not in all cases with operational issues causing underperformance in some cases.

- M&A has been active in the gold sector which has delivered some standout wins for investors who selected the targets.