Hi Charles,

You’re correct, a large an encompassing question, certainly a morning report in it, i.e. “When does MM plan to move to a defensive stance?”.

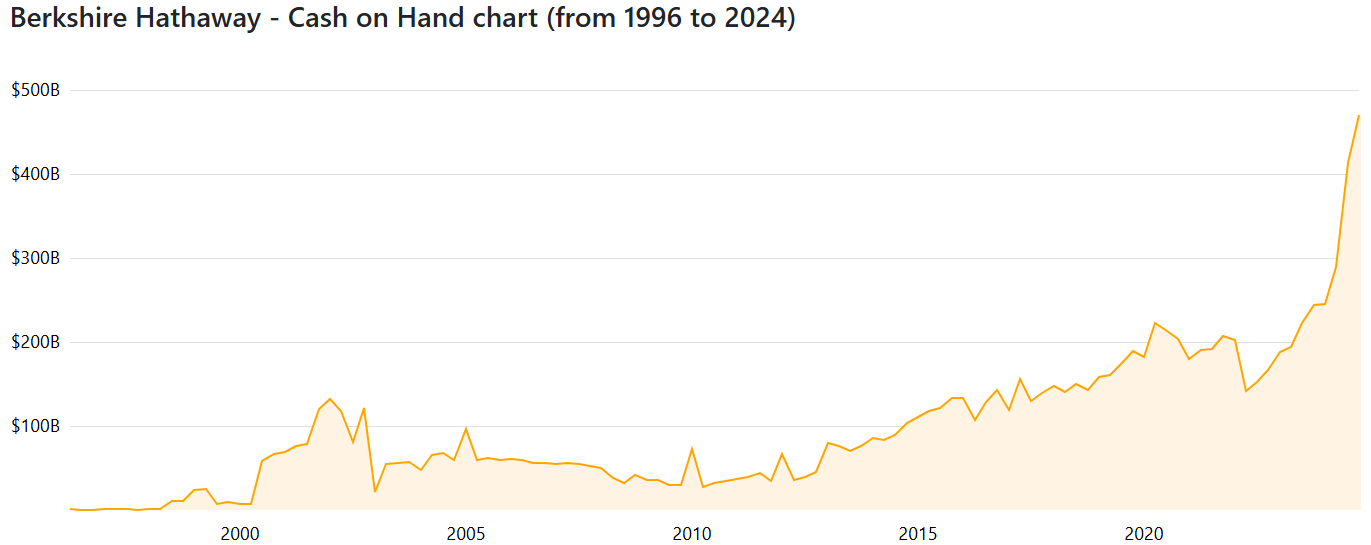

Firstly as you say Warren Buffett’s Berkshire Hathaway has increased its “war chest” of cash to very high levels as the chart below shows. This cash was largely accumulated through significant stock sales, including those of Bank of America and Apple, plus a slowdown in stock buybacks. There are few takes on why he’s positioned this way:

- He believes the market is too expensive and better opportunities will be available in the coming years.

- He needs the cash for another major takeover/purchase, some people are talking insurance.

- He’s simply getting more risk averse at 94, who could blame him!

What we would caution against is simply following Berkshire. Cash levels may be high, but their returns over a long period of time have been driven by investing, not holding cash. Investing over time in a considered and consistent way is what generates $$. Fretting about a looming correction does not. That sort of approach lends itself to having long periods out of the market.

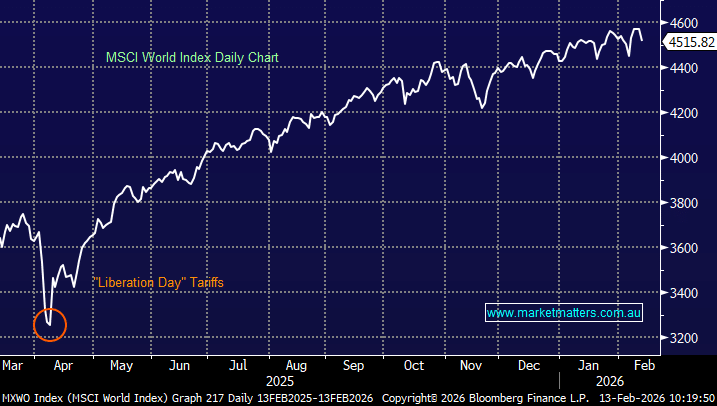

That said, your point around defensive equities makes sense and in terms of triggers for a more defensive stance for MM, there are short term triggers and more meaningful, medium term triggers. Short term financial metrics that highlight imbalances in credit markets are one primary area we focus on. We also talk to a lot of companies, and we get a sense of how things are performing from an underlying economic sense. At the moment, credit markets are fine and growth is holdings up, better than anyone thought it would, which is why rate cuts are not happening at the pace people anticipated. In short, like everything is markets, its about putting the pieces of the puzzle together to form a view. Our view for now remains a positive one.

- When we do adopt a more defensive stance APA and AGL will be on the menu, along with consumer staples and healthcare plus cash and fixed income for example.