Hi Glenn,

….13 minutes late but we feel generous as its Christmas!

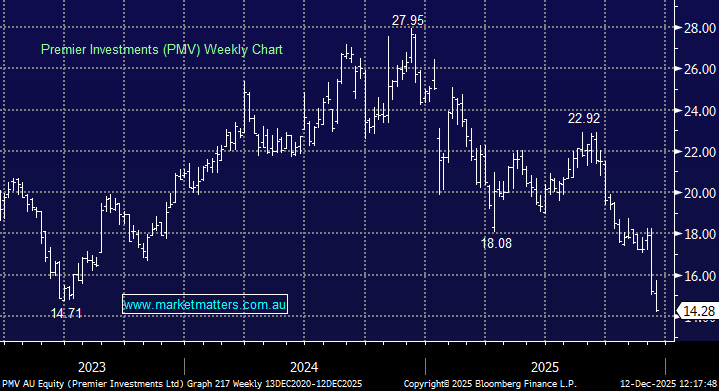

PMV has had a string of weaker updates, the latest one at their AGM last week with weakness in Smiggle the main culprit. That prompted downgrades accross the board.

- Target Price Cut 14% to A$20.60/Share by Morgan Stanley

- Target Price Cut 22% to A$16.20/Share by Macquarie

- Target Price Cut 21% to A$19.00/Share by UBS

- Target Price Cut 30% to A$16.70/Share by Citi

With discretionary spending headwinds likely through 2026 particularly if interest rates increase investors haven’t needed excuses to sell stocks across the sector since late October. PMV looks to have found some value support around $14 where its trading ~5% below its 5 year average PE, but its not “screaming” cheap yet. It feels wrong in the short term, until Smiggle can turn around; but buying overpriced PJ’s or nice to have stationary when the cost of a mortgage goes up is not high on many peoples agenda.