Hi Darren,

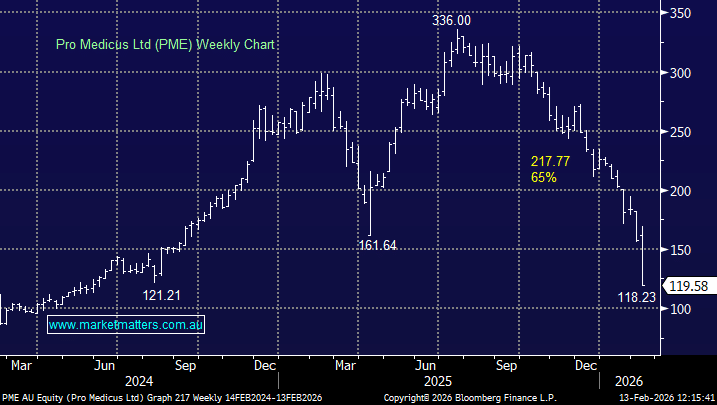

Medical software business Pro Medicus (PME) is now down 65% from its mid-2025 high as this week’s lift in first half earnings didn’t help appease the bears as it joins the sell-off in high value tech stocks:

- Profit for the half of $171.29mn was up from $51.7mn this time last year, however, when we remove a $149m pre-tax contribution from 4DX the result was a miss.

- Looking forward, there is some complexity around forecasting large contract win contributions i.e. we hear a lot about contract wins, but the actual $$ impact is harder to get a handle on.

- They declared a dividend of 32c up from 25c YoY.

With regard to AI, CEO Sam Hupert spoke a lot about it on the earnings call, emphasing the following:

- AI is a tailwind, not a threat — Hupert says AI will benefit, not disrupt, Pro Medicus.

- Investor fears are overblown — the market is over-generalising AI’s capabilities, especially in healthcare.

- AI is already embedded — Pro Medicus has been building and using AI in Visage for years, not reacting late.

- Proprietary moat remains strong — Visage’s AI is bespoke, not open-source, and hasn’t been replicated in 16 years.

- Healthcare limits disruption risk — zero tolerance for errors makes rapid AI substitution unrealistic.

- Customers aren’t worried — hospitals are signing longer (5–10 year) contracts, not shorter ones.

We agree to an extent, however, the technological moat that PME has enjoyed for 16 years as Sam highlighted is probably more at risk today than it ever has been. AI will level the playing field, and there is no doubt, the competitive landscape will change as a result. They do have insulation given the regulated nature of healthcare, and that could be enough, but we’re not sure. It comes down to price and what’s a fair valuation for a business that’s growing earnings at ~30% a year, but has more uncertainties today than it did 12 months ago. We probably think 80x is still a bit rich.

- We aren’t considering PME at the moment, it’s in our too hard basket.

Hansen Technologies (HSN) is a utility billing software provider and as such has struggled in recent weeks as fear around AI disruption wash through the sector. You are right Darren, it has been more resilient than some, but has still traded lower.

AI is clearly a risk for them, but we think HSN is far less exposed to AI disruption than say media, research, consulting or workflow SaaS companies. When thinking about HSN relative to PME, HSN will do revenue of something like $415m in FY26, making ~$55m in profit, and the company has a market cap of ~$900m.

PME will do revenue of ~$275m, has great margins, so profit will be something like $150m, however, they’re a $12.5bn company. There is still a lot of blue sky priced in relative to HSN and others.

- We think the risk/reward in HSN still stacks up well.