Hi Geoff,

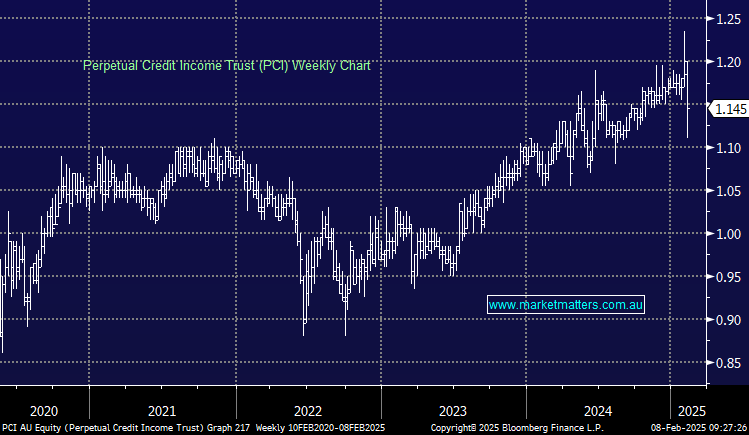

The unit price has traded well above NTA a few times and that’s a result of people bidding it up above where they should, which is the point you make. It hit $1.235 the other day, which is ridiculous, then was quickly sold back down. At that time, there were two other IPO’s on offer, from Dominion (Realm) and MA Financial, both similar sorts of income exposures. When investors have the option of buying a new deal at NTA, selling one trading above NTA to fund makes sense.

We prefer to keep a handle on the volatility or otherwise of the underlying portfolio and this is shown through the NTA which is released to the ASX daily. PCI has been stable and is doing what it should be. There are several differences with PCI and the ETFs you mention impacting how they trade. PCI’s market pricing is dictated by natural supply and demand of a set number of units. Open ended ETFs issue and redeem units based on underlying demand. When you buy an ETF, you trade with a market maker (generally), and they go and hedge in the underlying market i.e. buy or sell the underlying securities to facilitate the issuance or redemption of units. Market makers can make money from arbitraging that difference, so if an ETF trades above or below the value of the underlying portfolio, it corrects very quickly, given there is money to be made in the arb. Hope that makes sense.

We have not looked at the JP Morgan Equity Income ETF before – we will do so in the not-too-distant future.