Hi Rob,

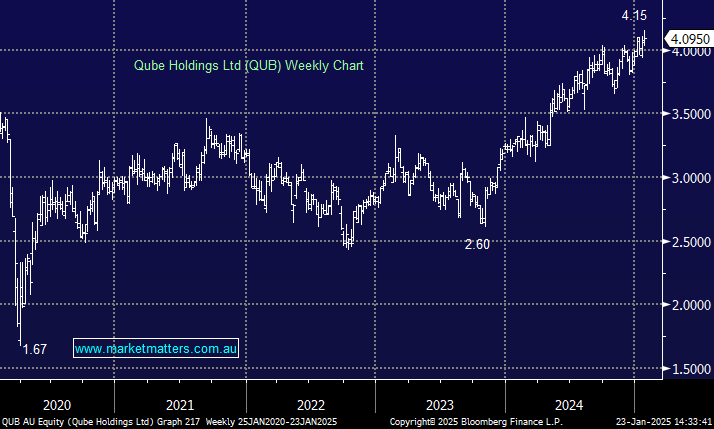

QUB pushed to fresh all-time highs this week as the “strong keep getting stronger”. The logistics companies Est P/E for 2025 is 26.4x which is actually on the cheap side compared to the last 5-years, and for a business supported by solid financial results, strategic expansion, and positive market sentiment it looks ok to MM.

- Strong financial performance: In the fiscal year ending June 30, 2024, Qube reported a +17.2% increase in revenue, reaching $3.5 billion and EBITDA rose by +14.9% to $534.1 million, indicating improved operational efficiency. If global growth picks up under a Trump presidency and an improving China, QUB is well positioned.

- Business alignments: Qube, co-owner of Patrick Stevedores, experienced a 32.2% profit surge due to increased market share during competitor industrial actions.

- Diversification: The $119 million acquisition of Coleman expanded Qube’s portfolio into mining-related logistics, diversifying its service offerings.

We like QUB as a high-quality defensive industrial.