Hi Ron,

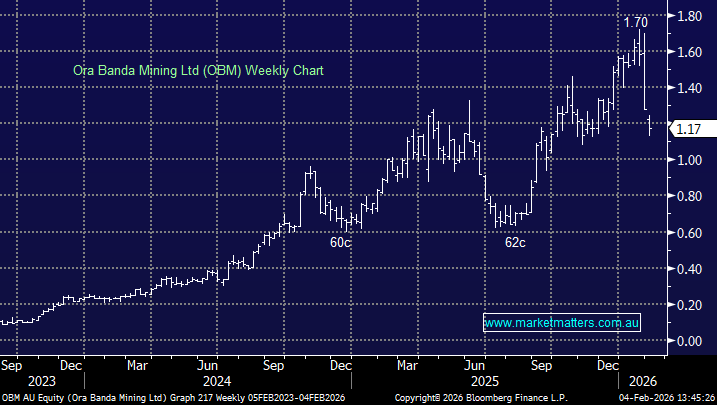

Ora Banda Mining (OBM) is an Australian gold mining company. It explores and produces gold, mainly from its Davyhurst project near Kalgoorlie in Western Australia. This $2.25bn miner enjoyed over $400mn in revenue in FY25 which is set to increase close to $1bn by FY27 – depending on gold prices and operational execution. The miner delivered a mixed report in late January which saw the stock tumble ~14% on the day:

- They forecast AISC for the year of $A3250-3350 up from the previous $A2800-$A2900 – a 15% hike.

- Higher costs are a result of lower production – they now see gold production at the low end of its 140,000-155,000 guidance.

OBM has the potential to maintain or grow above ~150k oz/year if exploration and plant expansion succeed, with resource growth underpinning longer mine life and production rates. If these things come off, this will be a great stock, but there are a few variables at play here. The most recent update saw some downgrades amplified by a pullback in gold prices – the perfect 1-2 combination for OBM, however, management are solid, and the resource is good.

- We think OBM is a high risk/high reward gold stock, that now looks very attractive ~$1.10.