Hi David,

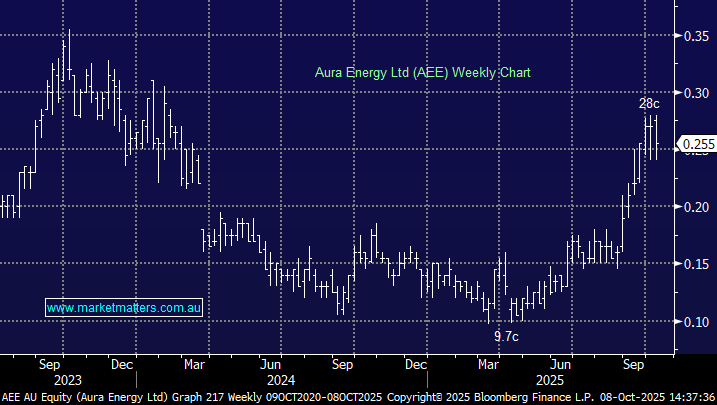

The AEEOC options are what’s called an “American” as opposed to “European” option, which means you can exercise (convert) them to AEE shares whenever you want, before the 30th of May, BUT we wouldn’t pay 30c when a stock is trading at 25c.

So why do they have value now? That revolves around the optionlity of time, and the cost of capital. Instead of outlaying capital to buy shares, we could just buy the options and get full upside above 30c, with only 4c downside, giving holders the ability to benefit from a sharp appreciation in AEE for relatively small outlay.

In certain circumstances, it can make sense for investors to sell the stock, and hold or buy the options, providing the same economic benefit above 30c. 4c does seem a bit excessive though – it would make more sense to do that if they were trading more like 2c in the next month.

If AEE shares are trading at 30c or below come May, the options will be worthless. However, in our experince, there is a tendancy for companies to try and get the options exercised, so they can issue more shares and get more capital in the door, and for that to happen, shares would need to be trading north of 30c.