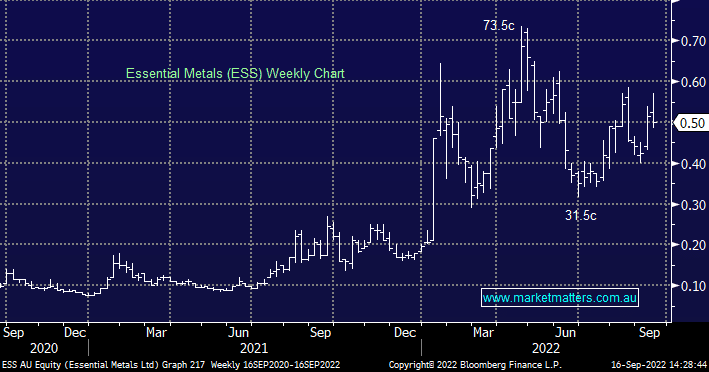

What’s MM’s thoughts on ESS’s options?

I have ridden the up and down waves with ESS (previously PIO) over many years and feel that there is some optimism with the company at this time. I was issued with some options many months back which expire in November 2022. Does that mean I need to convert them at that time or take another action to gain benefit? I understandable they are tradeable before that date. Thanks and regards Brian