Oil and Energy – how to play it when the cycle turns

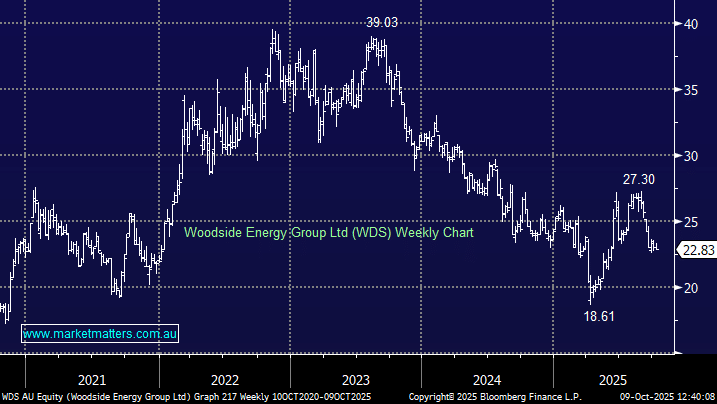

Hi guys, I love being a bit of a contrarian and taking positions in really unloved sectors or sold off stocks is something I enjoy (of course acknowledging fully that strategy only works if its a contrarian play rather than a falling knife!) For instance, gold stocks were cheap and a bit unloved from 2021 to 2022 and i took positions then, sitting on stocks not moving for a while, I also bought into James Hardie when it had a big sell down end of 2022 (recently just bought back in). The point is, im willing to take a position if i think its cyclical or short term and it doesnt bother me if I'm too early. Is energy and oil stocks (putting aside uraniam) particularly unloved at the moment? If I were to say that at some point there will be a turn around in energy and oil, maybe in 6 months, maybe in 12, but if i was inclined to think at some point the cycle will turn - what do you think is the best way to play a turn around in energy and oil? Woodside? FUEL ETF (though that doesn't seem to be particularly unloved). Also, if you could give some details about what do you think we would need to have a turnaround. Thanks so much for all your advice and work. Cheers, Josh