Hi Glenn,

Self-storage manager NSR announced a JV with Singapore Sovereign Wealth fund GIC to develop an initial portfolio of 10 assets, with the partnership planning to deploy $270m within the next 18 months.

- NSR will own 25% of the venture but will act as the manager for the initial 5-year term.

- NSR will reap $120m from asset sales into the fund, helping to reduce debt.

- The deal shows plenty of interest in Australian storage assets and the announcement leaves the door ajar for a far bigger investment from the fund which controls ~$US750b.

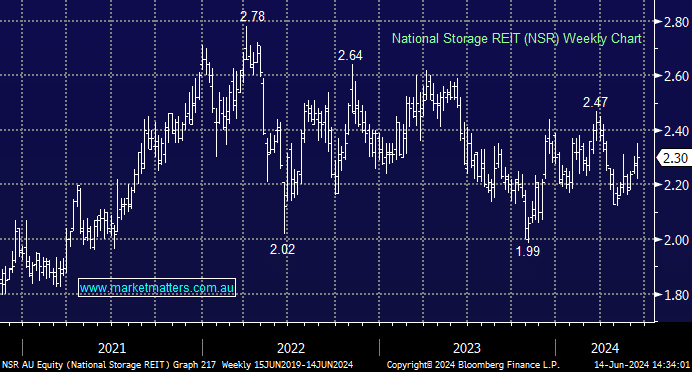

We discussed NSR in Fridays webinar, it’s one of our top, albeit a conservative picks for MM view that global interest rates will decline through 2024/5. We like it and the level of DD conducted by GIC gives us more confidence in NSR’s operations.