Hi Geoff,

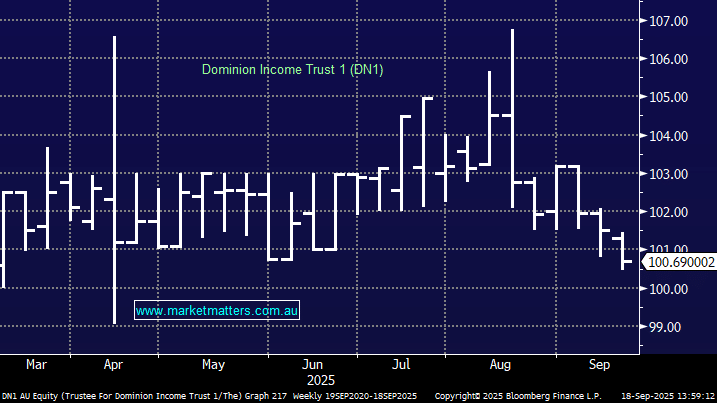

The Dominion Income Trust 1 (DN1) has shown relatively stable price movements, trading within a narrow band of around $101-103 bar a few bigger spikes which happens when buyers or sellers don’t use limit prices when buying or selling a security that doesn’t trade with huge volume. Additonally, there would be some some effects from distribution timing, interest rate changes (via BBSW), and shifts in credit market sentiment. As an income-focused trust, most returns come from yield rather than capital growth, which is likely to decline as interest rates fall.

NB We hold the Dominion Income Trust 1 (DN1) in the MM Active Income Portfolio.

The Dominion Income Trust (DN1) and (DMNHA) have a few small differences:

- The DN1 pays a higher return (3.50% vs 3.00%) but has a slightly shorter call period.

- DMNHA is a note (like a bond), while DN1 is a trust that holds a note.

- Both aims to provide steady monthly income and have protection buffers in case of losses.

We think Realm (who own Dominion) is a good steady manager, making sensible decisions when they deploy capital, charging a fair fee.

The launch of DMNHA may slightly reduce demand for DN1 by offering a similar income option, which could put mild downward pressure on DN1’s price or limit its upside, but we don’t think this will be a major issue given the $$ coming out of bank hybrids.