Hi David,

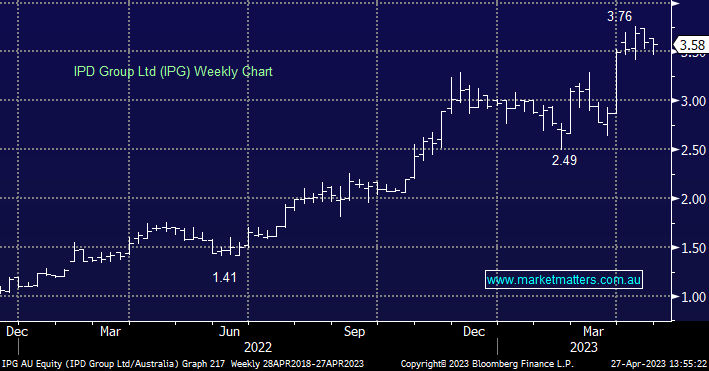

For those not familiar, IPG is a $315mn business that distributes electronic parts and communication equipment with an emphasis on the renewable sector. The stock currently looks great having rallied from $1.50 to ~$3.50 over the last 12 months, however it’s still not prohibitively expensive trading on a 20x plus its started to pay a reasonable dividend since August 2022.

We like IPG after its demonstrated the ability to grow revenue which has led to the company starting to pay dividends, and we have been doing some work on this stock recently with it being earmarked for our Emerging Companies Portfolio.

We did have the company in at Shaw, and I have included the notes from that presentation here, along with a link to Philip Pepe’s most recent research report:

Notes from meeting:

- As more countries take action to reduce carbon emissions, demand continues to grow for the products and services essential to deliver responsible economic development

- IPD Group is a vertically integrated provider of end to end solutions to the Australian electrical market that help make it possible.

- In Australia in 2022, Electric Vehicle (EV) sales almost doubled with 3.8% of all new cars purchased being electric.

- In 2022, Australia had 4,943 public EV chargers. Of those, only 464 were fast chargers.

- We’ll likely require ~20x more public chargers in 2030 compared to today.

- The Australian Electric Vehicle Council estimates that 1 million EVs are needed on the road by 2027 to reach our Net Zero by 2050 commitments. That equates to a 12 fold increase from the 2022 level. 2.8 million chargers required by 2030.

- Forecast $18-$20 billion of investment is required.

- 16 of the largest global car makers to phase out Internal Combustion Engines (ICE) by 2040.

- IPD Group / Gemtek is a total EV charging solutions provider offering services such as: consultancy, hardware selection, software, project management, installation & commissioning, client & operator training, remote monitoring & operation, and maintenance & repairs.

Research Note Available Here dated 24th February