What MM’s current thoughts towards the Nasdaq?

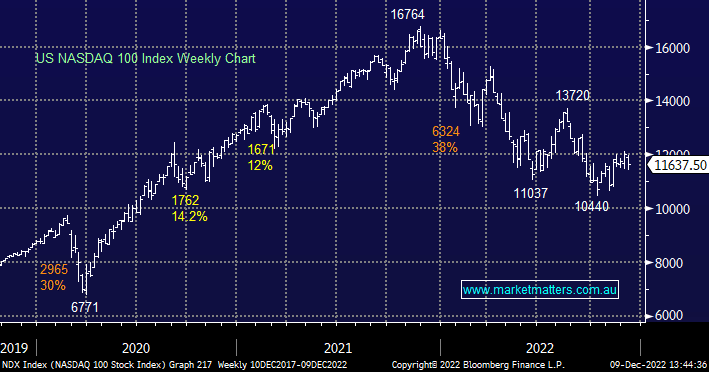

Hi guys, Appreciate all the work which goes on behind the scenes and good job with the daily reports. Can I ask your thoughts on the Nasdaq? I'm pretty heavily leveraged as I've been expecting a decent recovery. I've had a few targets marked for what seems like most of the year, but so far, I've been left waiting and starting to doubt if a recovery will happen any time in the next year. I've had 14300 marked for most of the year as my longer term TP. 13700 and 12500. Have you got any thoughts on next weeks Fed moves or PPI guess for Friday night? I'm a bit concerned that the last 4 months gains could be wiped out if next week sees another 0.75% rate hike. Do you think the ~15% recovery was all that was in the tank? I'm considering existing the position if we get a run to $12000 for the Santa rally - My fingers are crossed. Regards, Simon