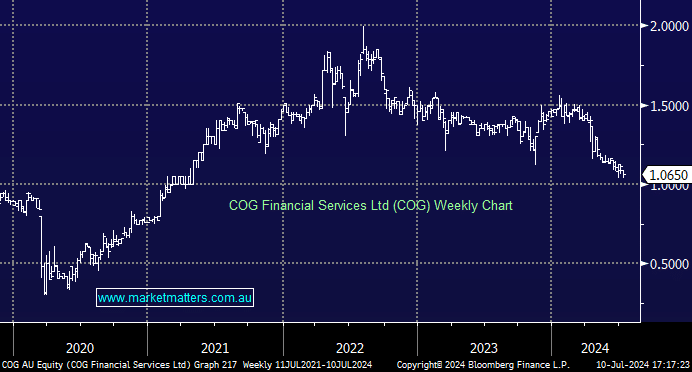

MM’s view on COG Financial Services (COG)

Before asking my question, I would like to thank you for the valuable opinions and analyses of the macroenvironment and stock selection. They brought me quite a lot of successs. Now a question on COG. I noticed the stock has drifted down continuously and has almost reached the support level. With a dividend yield of >8% fully franked, do you thnk it is now an opportunity to buy or it could be a dividend trap?