Hi Justin,

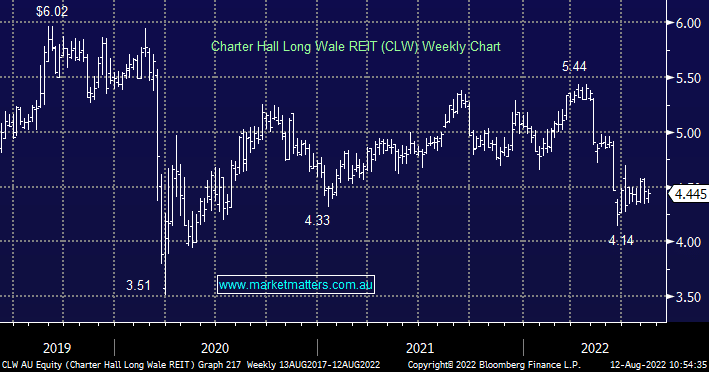

The Charter Hall Long WALE REIT (CLW) as you say is a very high quality property company, good, primarily government tenants on very long leases. The fact it is trading at a discount to NTA tells you the market believes the value of their underlying portfolio will come down over time through lower valuations – or in other words, the market is forward looking and is already pricing a degree of pain to come. To close the gap between NTA which sits at $6.17 and the share price which is $4.46 requires one of two things. The NTA falls or the share prices rallies. For the share price to rise, I suspect they will need to show evidence that their property portfolio is not declining in value over time. Another consideration here is longer dated bond yields. Rising yields are a negative for CLW, falling yields are a positive – I tend to look at CLW as a longer dated bond paying a forecast yield of 7.08%. Bonds have been sold off pushing yields sharply higher. We think this is a mature trend and if that is the case, CLW should be at a low point. I like it here for those with some patience.