Hi David,

Two interesting stocks here:

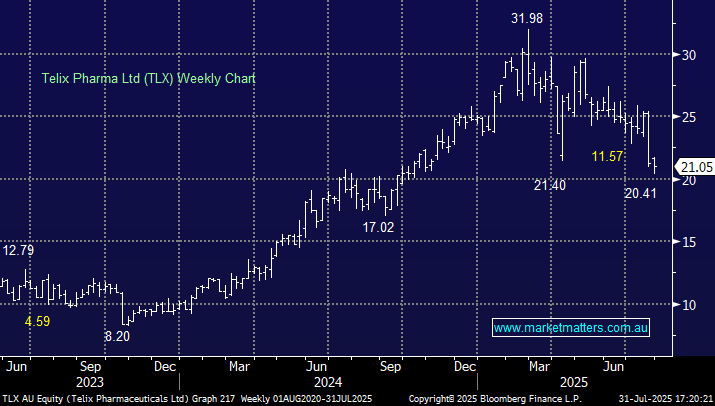

Telix Pharma (TLX) – this quality biotech endured 48-hours to forget in July:

- On July 22, it reaffirmed its full-year 2025 revenue guidance ($770–800 million) but disclosed it would increase R&D spend by 20–25%, raising concerns about narrowing near‑term margins. Despite solid Q2 results, 63% YoY revenue growth to US $204 million, the stock retreated.

- On July 23, TLX disclosed it received a “fact-finding” subpoena from the U.S. SEC related to disclosures around its prostate cancer therapy candidates. The uncertainty rattled investors, despite TLX confirming no impact to its core commercial product, Illuccix.

The stock subsequently plunged ~16% last week, extending its correction from its February high to a painful 36%. We now like the risk/reward in the $20-21 region but investors should acknowledge the volatility this stock often delivers in both directions.

Blocks’ (XYZ) revenue is predominantly underpinned by its Cash App +60%, followed by its Square merchant services (~37%), with smaller contributions from its other ventures. Growth across both core segments is slowing, prompting the company to double down on AI-powered features, credit products, and deeper ecosystem integrations to rekindle momentum.

- XYZ does generate revenue from Bitcoin, but the profit margin is low, most of it comes from facilitating Bitcoin sales through its Cash App.

The stock enjoyed a sharp rally a few weeks ago which was largely driven by its inclusion in the S&P 500 index, this inclusion triggered an “index effect”, spurring institutional and passive fund flows into the stock, helping boost its price by around 20% in a short span. We are neutral around the $120 level as the company looks to reinvent itself.