Morning George,

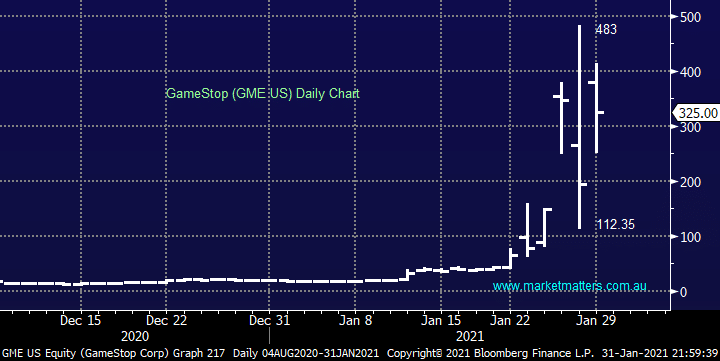

This is a fascinating subject on which I could write reams, but most have already been covered in the plethora of coverage which GameStop (GME US) et al has received over the last week hence I’ve simply passed on a few of my personal thoughts:

1 – I have no issue with investors / traders being able to short a stock, if they are correct as we saw with retailer Myer (MYR) they profit nicely but when they get it wrong and a business turns the corner, or is simply far healthier than many expected, they lose & sometimes big time e.g. Tesla (TSLA US). When a short goes against you, the problem gets bigger by the day, not smaller as a long position would. After a short seller has sold a stock they will ultimately need to cover the position, especially when its rallying against them absorbing large quantities of cash in paper loses.

2 – Share prices are a reflection of a company’s future prospects over the long-term but day to price moves are random noise determined by order flow. I have total confidence that the market is an efficient weighing mechanism but the human emotions of “Fear & Greed” regularly drive prices over the short term which investors who have well laid out plans can often exploit.

3 – In terms of GameStop and other stocks being artificially ramped by social media platforms my feeling is if hedge funds were carrying a manageable position size and they still felt the company was a short such actions should be regarded as Christmas providing the perfect opportunity to average. However, if they are already “all in” they’re money management should be questioned as they take what’s obviously huge losses.

4 – Markets should be fair and equitable and what has occurred in the US is not and subsequently in our opinion wrong. Exchanges and bodies like ASIC are supposed to ensure markets are orderly but in our opinion that should apply to both professional and retail investors alike i.e. in essence we agree with you!

5 – The clear issue with Robinhood is that they profess to be the ‘peoples champion’ however they sell their order flow to wall street to make money allowing them to offer fee free trading to the masses. Remember, there is no free lunches in this world, something that is free has an embedded cost somewhere. I much prefer a transparent approach, here’s our fee, this is our service, you make the call! If it’s too good to be true, it usually is, 60 minutes highlighted that last night.