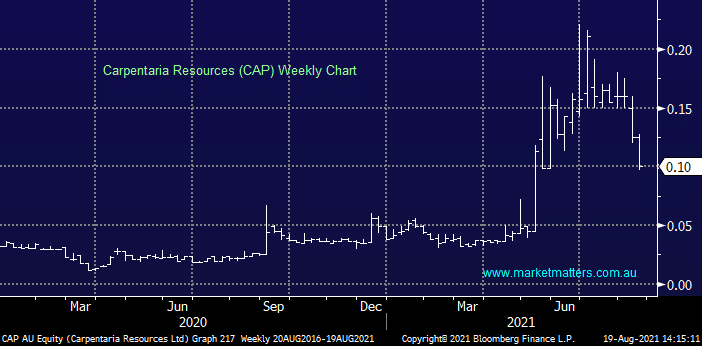

MM thoughts on Carpentaria Resources (CAP)

Hi James and team,

Thanks for your valuable insights and judgement calls over the last couple of years--my portfolio thanks you from the heart of its bottom line!! 2 Questions if may--at your leisure- regarding your thoughts on CAP (shortly to be re-named Hawsons Iron)? Background:-I have a “substantial” (top 40 I think) parcel in my pension phase SMSF portfolio -accumulated over last 2 years av price under 5 cents. It was an emotional (i.e. less than rational in a portfolio weighting sense..) purchase -me being an ex-Broken Hill “A-Grader”and all (BH natives will know what that means..lol)

The Company appears to have a massive, easily accessed very high quality resource of magnetite iron ore which is conveniently located -being close to Broken Hill and its mining centric infrastructure and skilled labour force. However its best case scenario right now is for first production in early/mid 2024 --Iron ore price permitting of course:

- What are your thoughts at the moment on CAP and its future? … I guess the question is whether one quits whilst ahead now or not...I’m happy to hold for a couple of years if the path is realistically positive from here.

- Setting aside the fact that there are any amount of “known unknowns” on the path to first production -is there any generally accepted way of calculating some kind of “big ball-park” estimate for a share price range once production starts (another assumption I know)?

It seems a black art--all seemingly plausible analysts calculations I have seen recently are literally miles apart....like 30-40 cents to 4 plus dollars!!!

Kind Regards, Paul