Hi Gruff.

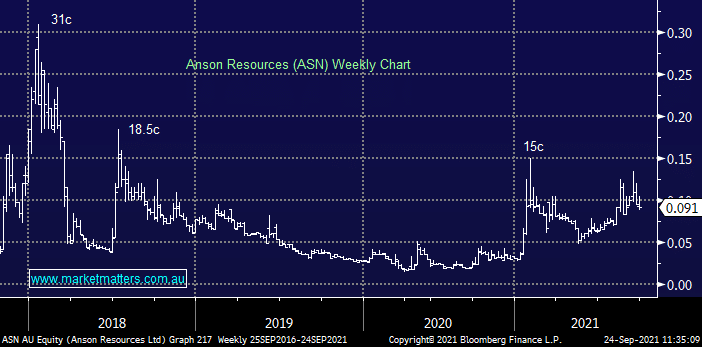

Thanks for being loyal subscriber it’s what helps us get up every morning! Anson Resources (ASN) is a $89m precious metals business based in WA which has on 4 occasions over recent years spiked higher only to fade away rapidly, not a characteristic we like to see.

The recent bonus offer gave shareholders 1 option for every 10 they hold with an exercise price of 9.1c, all as part of a $7.35m placement. For every option exercised shareholders will be granted another option with a strike price of 20c, above where its traded in the last few years. This is a simply a way of locking in a path of raising money in the future. If they get the share price through those strike prices then holders will exercise the options and the company will issue new shares thus raising money in the process. They often do this sort of thing for management as an incentive to get the share price up but it’s now becoming a more widely used strategy, and a cheap funding mechanism. At the end of the day, it’s a small company that will require capital to grow and this is a way for them to rope in existing shareholders to continue to fund the growth, or otherwise be diluted.