Hi Peter,

Short answer is we believe yes, however, the debt position is high right now so our position size will not exceed 5% of our Growth Portfolio.

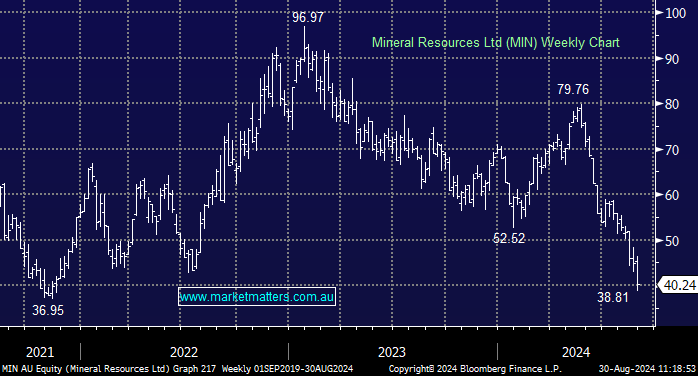

We believe they are being prudent not paying a dividend and tightening the proverbial belt in these tough times with lithium and iron ore prices in the doldrums. They operate a cyclical business which is hopefully approaching its nadir:

- Lithium prices have tumbled over 80% in just 18-months on increased supply and disappointing EV take up outside of China.

- Iron ore prices have fallen ~30% over the last 9-months as Chinas economy continues to languish.

CEO Chris Ellison said that, overall, the results highlight the strength of MIN’s business model, with diverse income streams all contributing to solid group earnings, despite a depressed lithium price:

“Given the stubborn lithium price and our remaining investment in Onslow Iron, we will continue to take a conservative approach during FY25, deferring expansion projects and focusing on cost reduction and cash preservation. This approach was reflected by the Board’s decision to not declare a final dividend for FY24,”