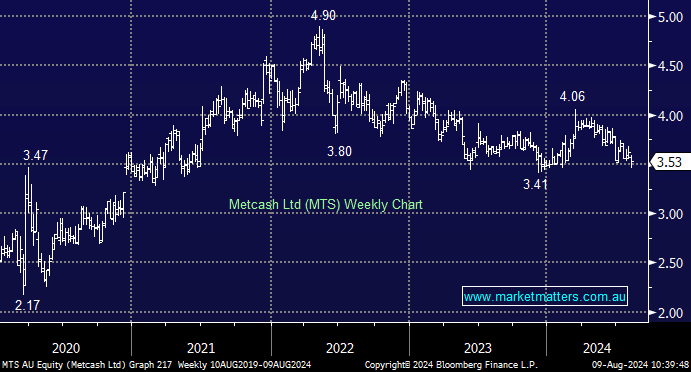

Metcash (MTS)

Hi Team,

Thankyou for your ongoing insights, which are very helpful. When looking at the performance of MTS vs WOW and COL since May, it appears that the market is focusing on "the bigger names" rather than the better metrics of MTS. Do you question the merits of "valuation differential" over a particular timeframe or is your philosophy more oriented to valuation ultimately prevailing. What might cause you to sell MTS?