Hi Debbie,

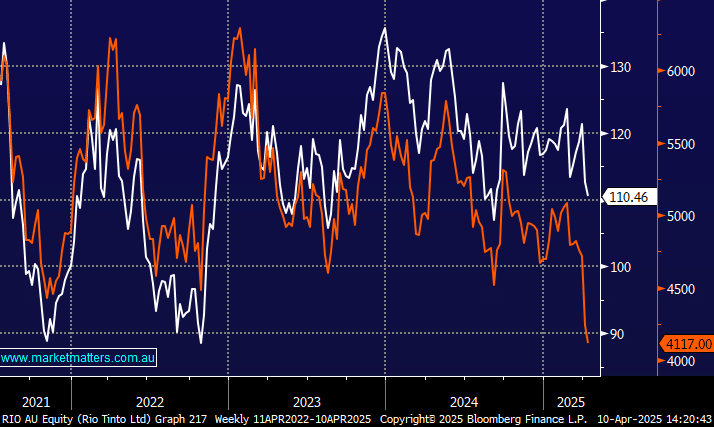

There’s a lot been written about this recently and our first reaction is its irrelevant compared to the price of iron ore (Fe) and the health of Chinas economy.

Activist investor Palliser Capital wants RIO to discontinue its dual-listing structure between London and Sydney, arguing that the current structure has led to significant lost shareholder value while restricting Rio Tinto’s ability to effectively utilise stock-based acquisitions. The board of RIO do not agree, believing it will result in substantial tax liabilities, estimated in the mid-single-digit billions, while also potentially causing the loss of franking credits that benefit Australian shareholders.

BHP unified its dual-listed structure in January 2022, which led to an increased weighting of BHP in the ASX 200 index, rising from approximately 6.2% to over 10%, making the miner the largest component of the index at that time. In August 2021, following the announcement of the unification plans, BHP shares closed down over 6% although they did rally in line with a strong market in the following six months.

- Overall MM doesn’t believe its a major issue in todays volatile and exciting market.