Hi Debbie,

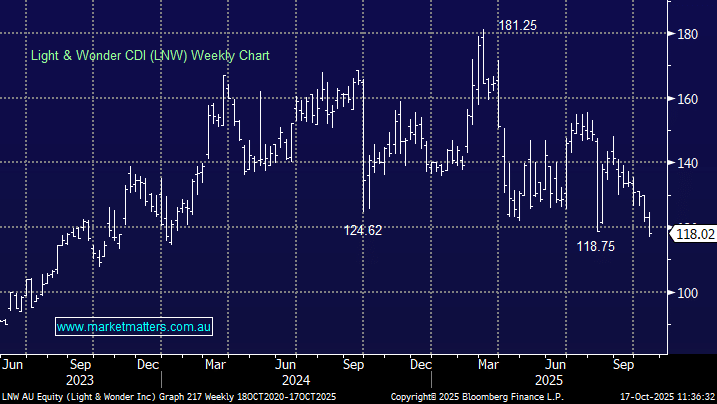

We still have LNW in our sights for our Emerging Companies Portfolio, but it’s been out of favour of late and as you say some shareholders (particularly U.S.-based or international) may not want to hold shares listed only on the ASX, due to currency, liquidity, regulatory, or brokerage access issues – in August LNW said that “…equity traded on the ASX now accounts for approximately 37 % of our total equity” suggesting the majority of activity still occurs in the US implying a large pool of potential sellers into November 13th.

- If LNW continues to fall over the coming weeks there’s a good chance MM will press the “Buy Button”.

Australian Strategic Materials (ASM) rallied almost 4x in the last 3-weeks before retreating ~25% on Wednesday/Thursday, a similar move to many rare earth’s names, just on steroids due to its small $360mn market cap. However, the stock went into a trading halt on Friday pending a material announcement which is likely to be an opportune capital raise. Obviously, we want to see the details of the announcement, but for us, we think there are other less risky stocks to get exposure to rare earths – but we don’t believe now is the right time.

When a sector runs really hard because of trade decisions that are subject to further negotiation – i.e. China’s move on Rare Earths ahead of a meeting between the two leaders, we think the risks are high that the dynamic driving the move could be unwound. We would be very reticent to put money into the sector after such a strong move given the risk that it could unwind very quickly.