Hi Debbie,

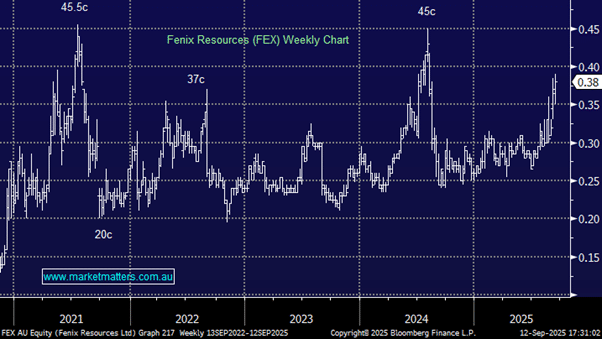

Fenix Resources (FEX): has rallied from 32c to 38c this month, against a backdrop of a strong iron ore sector where heavyweights BHP has advanced +3.1%, and FMG +3.2%. The Weld Range Iron Ore project is good news but it’s not a game changer and we anticipate the stock will dance to the bulk commodity tune. At this stage we believe it will be tough to punch through the 45c swing high.

Service Stream (SSM): Service Stream recently secured a major $1.6 billion Defence Base Services contract covering 113 sites and 8 major bases across South Australia and the Northern Territory. The six-year contract (starting February 2026) includes estate management, aerodrome operations, and training area services, with options to extend to 10 years.

The stocks already rerated stronly, and we think this could partly be due to the contract being in defence, and defence is a hot sector – investors extrapolate defence = exponetial growth. That’s not as applicable with SSM as they actually have to deliver real-life management of facilities, which requires people, incurs costs, has complexity etc – it’s not just a software applicable or a peice of technology! We think the SSM share price has enjoyed the defence narartive on this deal, and we’d be inclined to sell into it, if we held the stock.

- We are neutral towards SSM around $2.50.