Hi Deb,

These are indeed two very volatile stocks which are often driven by speculators on a day-to-day basis but if we look through the noise both stocks are enjoying a strong period as defence spending takes centre stage in the likes of Germany. If people get too close the human emotion of Fear & Greed will make it a tough ride, you need a plan whether as a trader or investor.

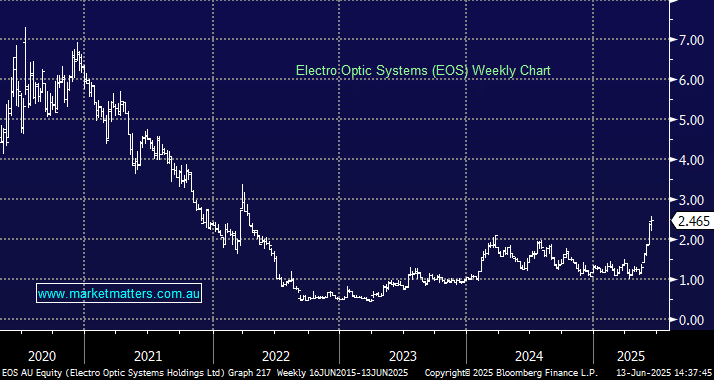

Electro Optic Systems (EOS) – EOS has more than doubled in 2025 after they completed the sale of its EM Solutions naval satcom business for $158 million in January shoring up its balance sheet. They also secured a €31 million contract for its Remote Weapon Systems (RWS) in Europe and announced a €15 million order for its SLINGER counter-drone system from a German customer.

- We like EOS into pullbacks around the $2.20 area – remember its volatile, use it to your advantage where possible.

DroneShield (DRO) – we have talked about DRO a bit of late and it is still in our EC Hitlist although after the last 2-weeks strength it looks like we will need to pay-up to get set.

- We now like DRO in the $1.60 region as global stability appears to be heading in the wrong direction.