Hi Khaled,

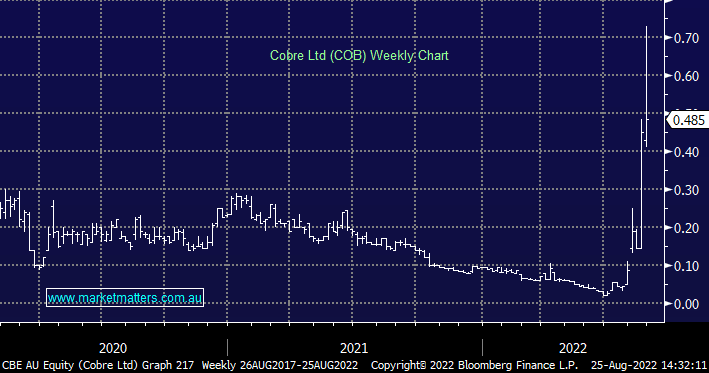

These are very “speccy” stocks, CBE has a market cap under $100mn and Arcadia Minerals (AM7) even lower sub $30mn. When companies have a relatively low market cap and average daily $$ turnover its not unusual for them to pop higher / lower on news however minor – both have subsequently dropped over 30% since their spike highs.

The information you are referring to generally comes from an ASX announcement, which was certainly the case with AM7 released at 9.25am on Wednesday 24th and then momentum feeds momentum, the day traders get involved and we see large moves. In both cases you refer to, if you had bought on the open the day the stock spiked higher you would hardly be making any $$ today i.e. these stocks are more akin to Bitcoin and not the domain of MM. e.g. Pendal (PDL) received a takeover bid from Perpetual (PPT) on Thursday and only advanced +8.4%

Unfortunately there are no silver bullets with regard to investing – learning to join the dots is the key and this comes with experience, but is never truly mastered, we hopefully just get better each year the more we are immersed in the market.