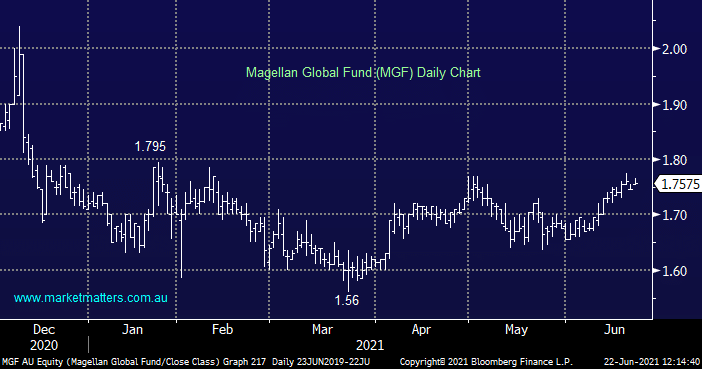

Magellan Global Fund (MGF)

Hi James, I am a holder of MGF, Magellan Global Fund (Closed Class), which at $1.76 is trading well below its NTA of $1.955. They currently have a share buyback in place and are buying back volumes of the stock almost every day. Since the restructure of the fund early in December something like 18% of the share turnover has been under the buyback. My question is what are they doing with the shares they are buying back? They also operate MGOC, Magellan Global Fund (Open Class), which is the same portfolio as MGF but the stock always trades at its NTA. If they were to take the cheap MGF stock they are buying back and re-issue (sell) it as new MGOC shares, they would be making a reasonable killing. Similarly, if they just sold the underlying stock holdings in the MGF shares that they’ve bought back, they make the same margin. So my question is do you have any idea what is going on? Les