Hi Darren,

This week saw LLC undertake a major capital recycling initiative by entering into a joint venture with the UK’s Crown Estate. This move is part of CEO Tony Lombardo’s strategy to refocus on the Australian market.

- LLC has formed a 50/50 joint venture with the UK’s Crown Estate, transferring six major UK development projects into this partnership for $300mn, slightly above “book value”.

This JV aligns with Lendlease’s broader strategy and may lead to some capital action:

- Analysts are now looking for LLC to consider a major stock buyback next year.

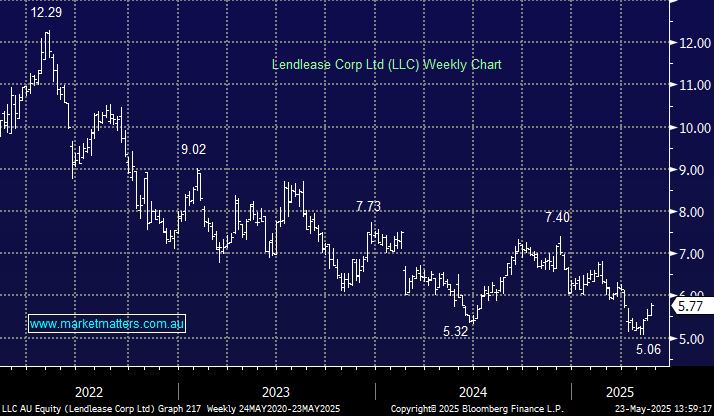

We can see LLC squeezing up towards $7 in the next 6-12 months, or 20% higher. The ongoing simplification of what was a very complex business generating low returns on capital is a positive thing, and this is the sort of strategy we were looking for when we owned it back in early 2024 (selling out at $6.18) – it has just taken a lot longer than we thought. On 10x FY25 earnings, and now with some identifiable catalysts, LLC is interesting again around ~$5.50. One we are now keeping a closer handle on.