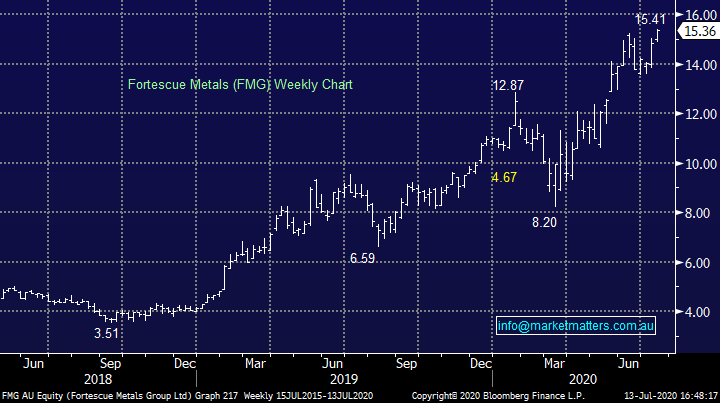

Reflation trade & Fortescue (FMG)

“Hi MM Team MM remains bullish commodities & the “reflation trade”. Can you please re-affirm these views in regards to FMG - Current Price $18.12 (YTD High $18.64). Would you continue to hold thru reporting period and dividend payout? When you read the following views: [leaky_paywall_subscriber]“However, given what we view to be emerging downside risks to the iron ore price and that, from our analysis, the current FMG share price implies the iron ore spot price will remain at these levels for the next three years, we are taking the view that FMG is indeed priced for perfection. While we regard a healthy final dividend (BPe A91cps) as locked in, we believe the downside risks around the iron ore price and FMG going ex-dividend (likely early September) are insufficient compared to our underlying valuation to justify holding through to those catalysts. We lower our recommendation to sell. “ TP $12.50” - regards Debbie G.[/leaky_paywall_subscriber]