Hi Mike,

Light & Wonder’s balance sheet appears highly leveraged because its reported equity is unusually small, not because its debt is out of control. Light & Wonder (formerly Scientific Games) underwent large asset sales, major restructuring, goodwill write-downs, spin-offs (including the sale of their lotteries business), and share buybacks. All of these reduce book equity, even if the business becomes financially healthier. This is an accounting outcome, not an operational one.

Because D/E is distorted, institutions and brokers use the following more meaningful metrics:

- Net Debt/EBITDA: for LNW this sits around 2.7×, which is normal and acceptable for a gaming/content business with recurring revenue.

- Free cash flow & interest coverage: LNW generates strong, stable free cash flow from its gaming and digital divisions and coverage is comfortable, meaning LNW has no repayment pressure.

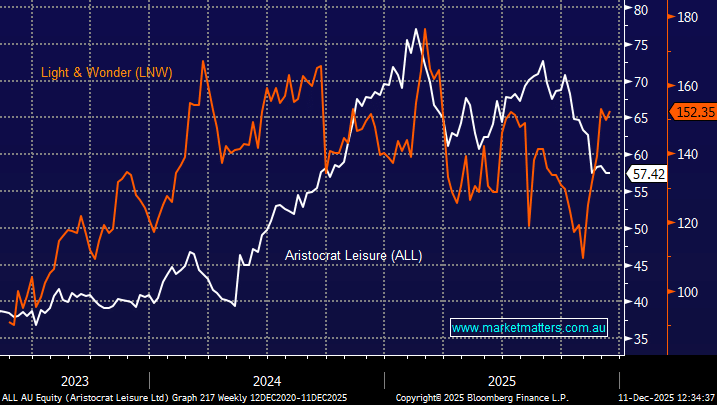

We covered LNW after their strong September Quarter Here it remains our preferred exposure to the global gaming sector, both online and land based.