Jupiter Mines for Income?

Hi MM Team.

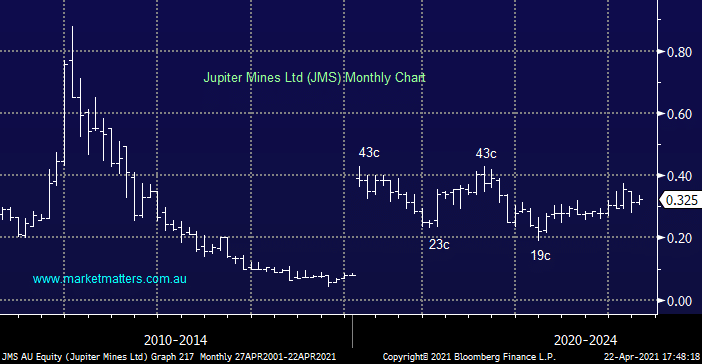

Could you give your thoughts on the merits of Jupiter Mines (JMS) as an income-generating investment? They have a 49% holding in a south African manganese mine, which seems to have negotiated the 2020-21 Covid year very well considering the problems with the virus in that part of the world. JMS have an unashamed commitment to high payout levels and a goal of double digit dividend yields. the price of manganese is currently quite low, so maybe with the world (hopefully) pulling out of the covid doldrums, JMS might get a fillip in that area too? Can MM see any merit in JMS as an income stock - or any pitfalls for the unwary?

Keep up the good work!