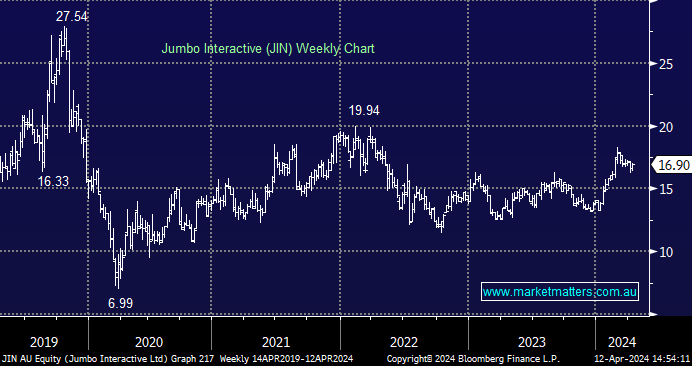

Jumbo Interactive (JIM) and Healius (HLS)

Do you think there's any hope for these two which are languishing in my portfolio? Tempted to cut them but then often in the past with the fullness of time it seems I would better have used such impulses as a contrarian indicator to buy more.