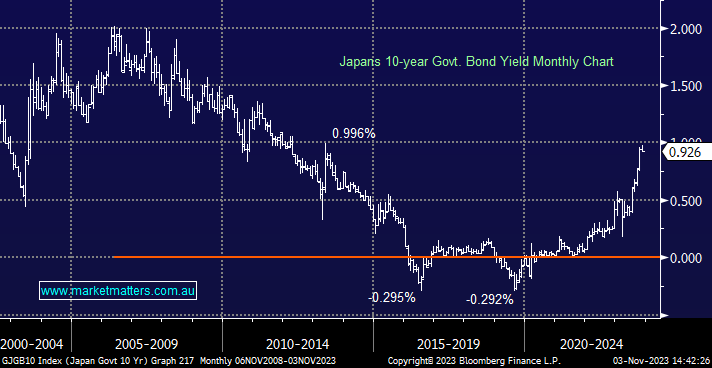

Thoughts on Japanese bonds/rates

Hi guys. Thanks for the behind-the-scenes work which go in. Could you give you thoughts and implications with the Japanese rate curve please. Obviously the currency is being targeted so push the rate control to be raised. If they were to allow the rates to go to 1.5-2% what would happen with our own bonds and equities, along with other international markets. How about exchange rates? How likely and timeframes for such a move? My understanding would be that our equities take a big hit and our bond yields surge; would they likely be to a similar change to that of Japan, for example, both increase at the same rate. I believe they also hold a large U.S. holding, will this have a leveraged effect? Regards, Simon. (Send via phone so apologies about any fat finger spelling)