Is Telstra (TLS) a serious candidate for a growth portfolio?

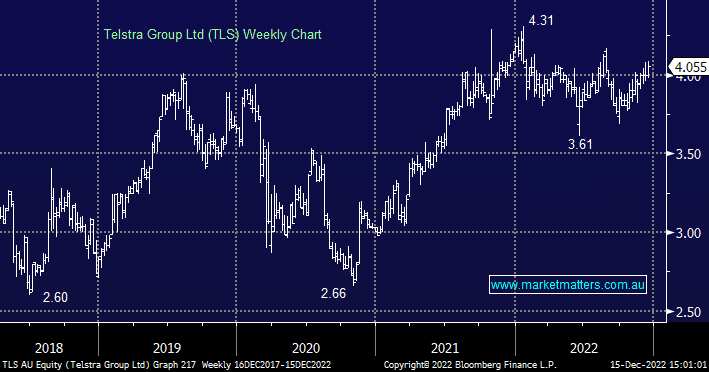

Telstra Share price has been range bound between about $3.88 & $4.02 since February, it is showing no ambition to go anywhere! Also the dividend yield of 4.14% is greater than the earnings yield of 4.01% Is this stock really a serious candidate for a "growth" portfolio.