Hi Alex,

PayPal (PYPL US) estimated P/E for 2022 is actually 21.5x based on Bloomberg Consensus with no profit growth factored in for FY22, before earnings rebound in FY23 and beyond with growth of 20%+. These sorts of numbers are understandable given consistent revenue growth of 15-18%. Margins, as you rightly point out are the issue in the nearer term and before we get positive again on the stock, we’d like to see some improvement here – the consensus is factoring in better margins from FY23 onwards but that’s a while away.

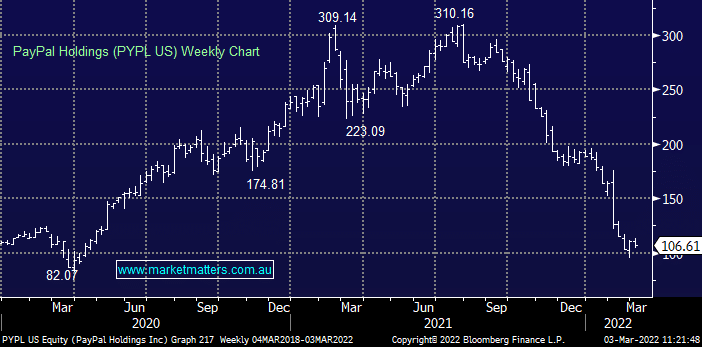

In the short term, we are still looking to sell this disappointing position into strength opposed to buying dips i.e. its a case of where we rip off the band aid. At this stage a bounce back towards $US140 is likely to see MM exit stage left with our tail between our legs for now.