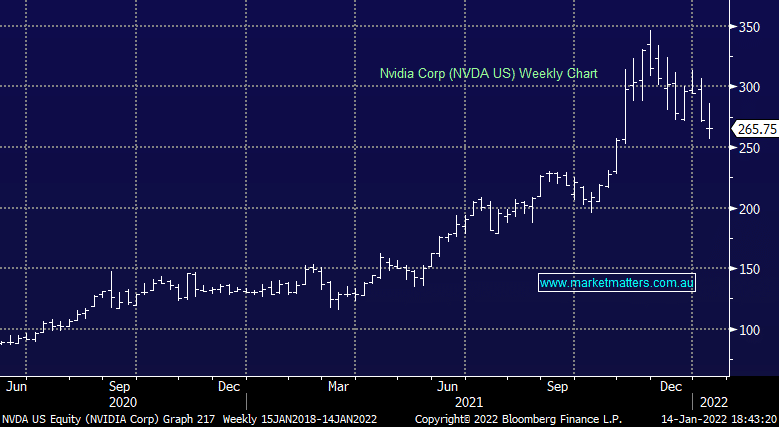

Is Nvidia attractive into recent weakness?

Nvidia (NVDA) has been a stellar performer over the past 5 years with 1000%+ return. While a growth stock which has benefited from low rates tailwind its EPS growth continues to impress. It seems to be one MM have not had a view on for inclusion in International portfolio. Having pulled back approx 20% in past few weeks in line with overall Nasdaq pullback interested to hear MM view on stock at this price?