Hi Glenn,

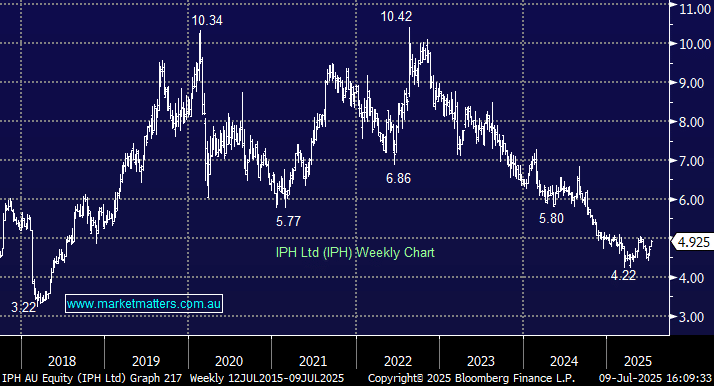

We discussed IPH earlier this year in the Q&A report where our conclusion was to keep it in the “too hard basket” – the stock was trading ~$5 at the time, basically where it is today.

The patent business has faced ongoing headwinds from a weakening in its Asian business, particularly in the intellectual property (IP) markets of China and Southeast Asia one thing we have in common with President Trump is the frustration with some countries blatant disregard to intellectual property – it’s much cheaper to copy & improve than develop from scratch! We have no doubt that AI will be a huge disruptor in the space, although it’s hard to predict whether it will benefit IPH from a costs perspective or just lower the barriers of entry for competitors, our bias is for the latter at this stage.

That said, IPH have performed pretty well in the first half of FY25:

- Revenue of $344.3mn was a 25.5% increase YoY and EBITDA of $100.5mn a 11% increase, with a margin of 29.2%.

The departure of the CFO in March shook investor confidence but the recovery has been encouraging. Debt levels remain a concern but the stocks relatively cheap as you say trading more than 1-standard deviation below its 5-yeaer average valuation, plus its forecast 7.9% part-franked yield over the next 12-months is definitely interesting, but we still think there are plenty of variables here that are hard to quantify.