Thoughts on interest rates and Symbio Holdings (SYM)

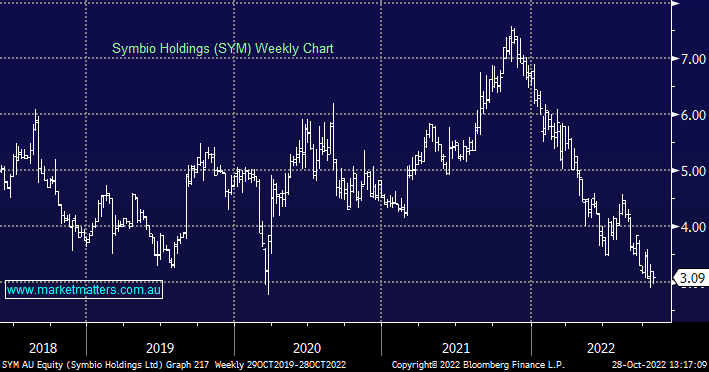

Thanks for your ongoing commentary... I read plenty of analysis (as well as yours on Friday) that compares the current cash rate to that of the 90's as relatively irrelevant, but my concern is that that is only a nominal comparison. The fact that most businesses and "mum's and dad's" tend to borrow close to their maximum capacity at whatever the available rate is at the time can actually mean MORE problems than in the 90's are going to develop soon due to the percentage increase of the servicing required with the current and expected rate increases today. Am I missing something? Also, Symbio Holdings (SYM) has continued to drift lower...do you have a current view on it? Thanks in anticipation...