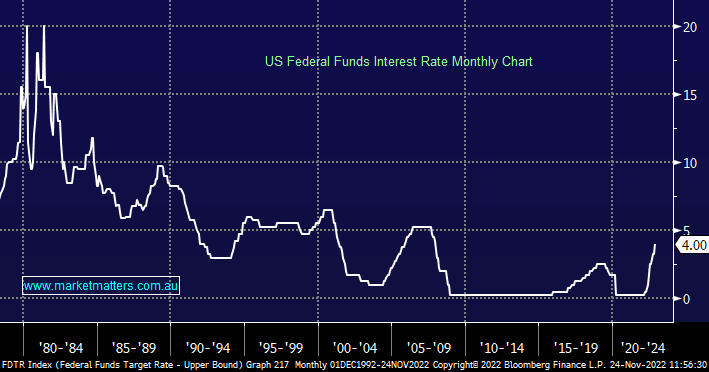

Can the Fed get inflation and interest rates correct?

Hi James, Shawn and Team, This is not really a question, just an observation. Back in July 2020 when many of us held Magellan investments, Hamish Douglas / Magellan published "video insights" featuring key internationals. In July 2020, Hamish discussed the then current financial situation with Janet Yellen. https://www.magellangroup.com.au/insights/inreview-perspectives-on-the-future-of-the-global-economy/ The interesting bit was Janet Yellen's perception at that time of the FED's QE , the many levers it has , persistent inflation , the need for very low interest rates for a very long time, etc. Fast forward to 2022 and all we see is one lever the FED and other Central Banks use, namely interest rate increases. If the former Chair of the FED reads the situation so poorly, what happened to all the levers they have / had to ensure a "soft-landing" ? As I read the MM reports and the comments regarding inflation / stagflation, higher interest rates, etc. I just wonder where this leaves us as investors ?? I don't have answers but I am more sceptical about Central Banks and their "understanding" and control of QE / QT Have a great day. JanP