Hi Charles,

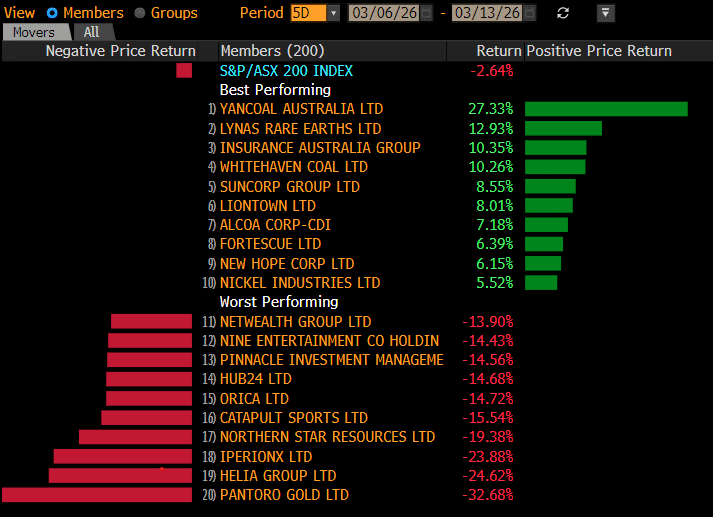

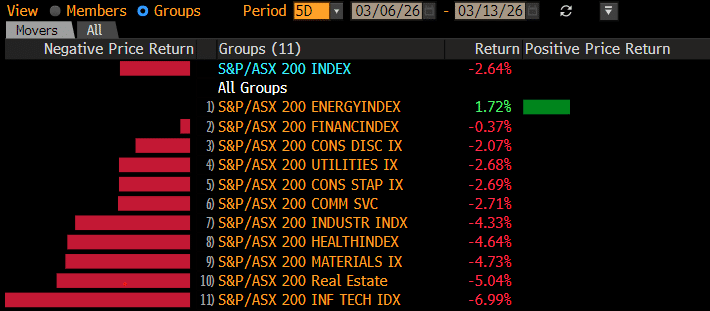

Thanks for comments, it’s been a definite game of two halves across our growth portfolio.

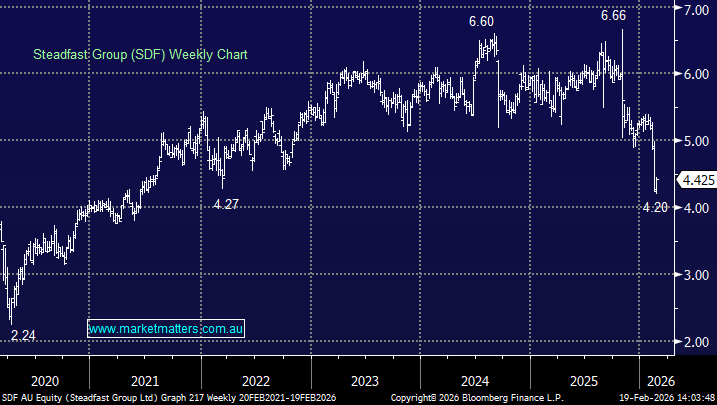

We discussed Steadfast Group (SDF) in detail in another question today, from a yield perspective we believe there are better places to invest, especially with SDF only forecast to yield ~4.5% fully franked over the coming 12-months, but with a lower level of predictability than typical yield stocks we like to have in the Income Portfolio.

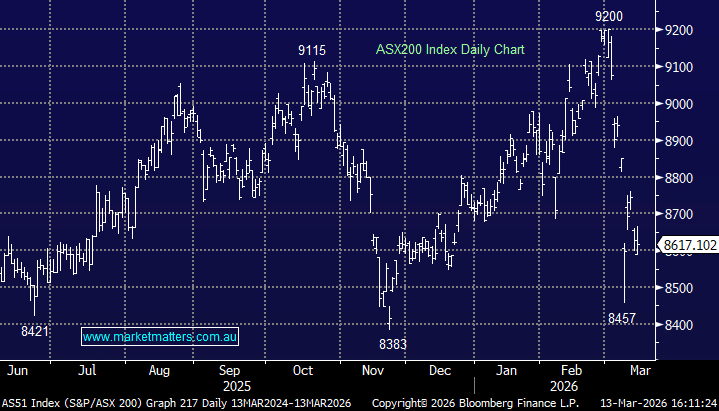

In terms of real estate stocks, we have got our eyes on three stocks – Mirvac (MGR), Dexus (DXS) and Charter Hall Long WALE REIT (CLW). The first two have reported in this cycle – solid results.

- We sold MGR back in October as the RBA and economic data turned more hawkish but with the stock now ~15% lower its more interesting following a solid 1H update.

- Australian real estate and infrastructure manager DXS excited the market this week after announcing its intention to buy back up to 10% of its stock believing the shares were trading well below the value of its underlying assets. We agree, but we’re also conscious of it’s high level of office exposure.

At this stage it’s a matter of “when not if” we buy at least one of these stocks, but Thursdays stronger than tipped jobs report, increased the bets of rate hikes which may weigh on the sector a touch longer.