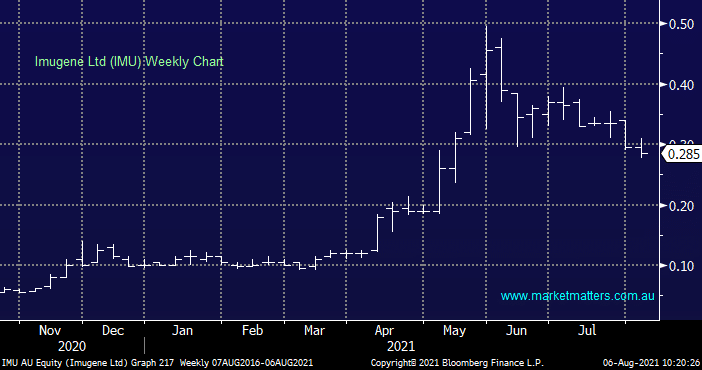

IMU & ICU – thought?

Hi James and Team,

Loving the updates please keep up the great work. I just wanted to hear your thoughts on the recent capital raise by IMU and if you see it as a positive for the company moving forward. I am particularly interested in your opinion on the new options being exercisable at $0.45 each on or before August 2024. (General advice only). Finally, ICT and if you see the future outlook and potential takeover of RDH as both positives.

Thanks

Jack R.