Hi Carol,

A very good point you make and one that has been made regarding other mining companies that can have lumpy growth rates in terms of earnings given their development pipeline. I.e sometimes they are reaping while other times they are sowing!

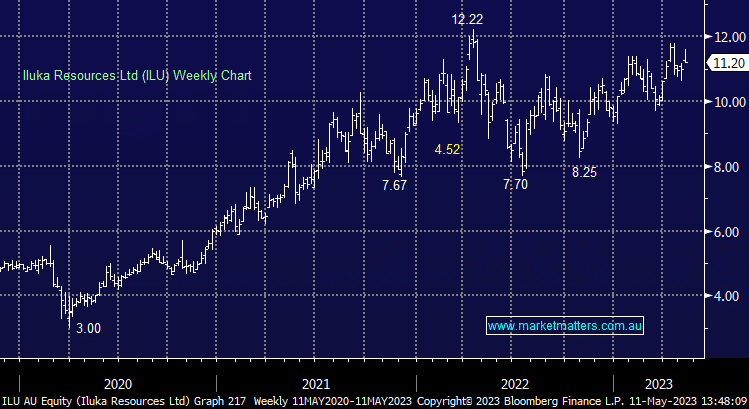

This is the case with Iluka (ILU), whereby their earnings (profits) are set to decline over the next few years as they build new projects with a focus on rare-earths. The board recently approved a $480m investment in the Balranald project where the economics look good. In simple terms, that investment will be paid back in around 3 years but will have around 9.5 years of mine-life. Because of these investments, their profits will be lower than they are now.

Regarding consensus recommendation you mention, it’s actually a HOLD recommendation based on the current price being around about the consensus target price.

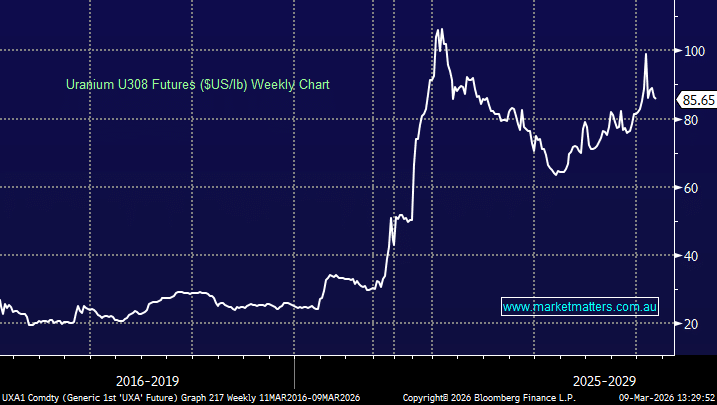

In terms of our view being a positive one, we are more optimistic on the value of their rare-earths development, and as that becomes a bigger proportion of the business overall, the market we think will pay more for it based on what other rare-earth companies are valued at. But as always, we can change our mind and move accordingly. Hope that helps.