Where do I start with Hybrids?

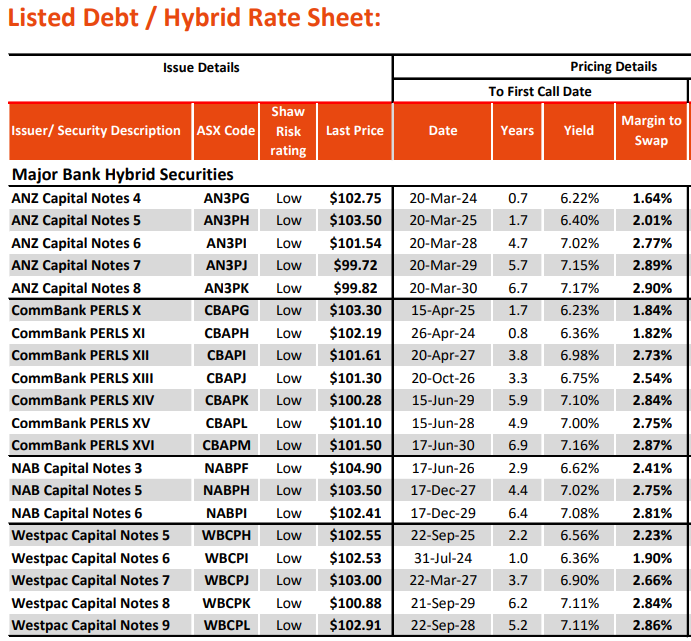

Thank you for your outstanding service, which I have been following using for a while now and have benefited from it very much. I particularly like your straightforward commentary and opinions. I wish to reduce the proportion of cash in my portfolio and would like to invest in hybrids or capital notes. However, being an unsophisticated investor, I don't know a lot about them, particularly in buying them through the open market (as opposed to subscribing for new issues). I note that your Income portfolio has a number of hybrids or capital notes, but how do I pick those that are appropriate for me? I am basically looking for a lower risk investment (to complement the higher risk stocks I already own), but at slighter better returns than available via bank interest. I would also be keen on a "floating" return, and one that has a relatively long time to maturity (say 5 years or greater) so I do not have to keep changing or buying new ones. Many thanks, John