Hi Geoff,

Frustrating we’re sure but i wouldn’t be too hard on yourself, they’ve gone nowhere fast for years:

Green Critical Minerals (GCM) a $75mn company that’s transitioning from a pure explorer into a vertically integrated producer of premium graphite products. Its VHD technology, paired with its McIntosh resource, it is said to position it to supply high-margin industrial markets by 2026, establishing itself in the trending critical minerals space.

In June a $7mn institutional placement at 1.2c strengthened GCM’s liquidity to accelerate VHD graphite commercialisation and advance McIntosh development, positioning the company toward its goal of first revenues in 1H 26 but it may cause some selling into strength – the stock was down 7% on Friday.

- We could only trade/invest in GCM using technical s which requires stops under 2.2c.

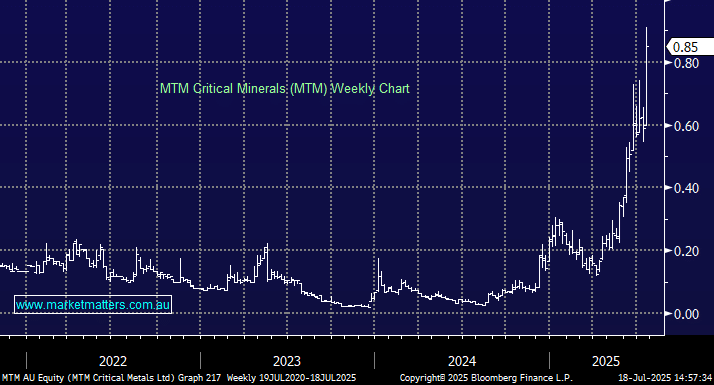

MTM Critical Minerals (MTM) a $440mn company which combines traditional mineral exploration with advanced processing technology, targeting both resource upside and near-term revenue. Its rapid deployment in the U.S., focus on critical minerals, and high-value tech stack position it as a standout in the burgeoning critical-metals and recycling space – the company is soon to rebrand as Metallium Ltd.

In 1H 25 they lost $3.3mn but they had $5.4mn of cash on its balance sheet, breakeven is not expected before 2027 without further capital or partnerships implying a capital raise is a distinct possibility.

- Technically the stock looks good around 85c with stops under 70c from a trading perspective.