Hi David,

There are a lot more variables when it comes to the miners relative to the physical. Operational performance is a big one while the degree of hedging carried by the respective companies is also important. i.e. they forward sell gold at lower prices to get certainty which provides a hand break in a strong market.

In general, we don’t expect the gold miners to play significant catch up to physical gold unless they enjoy the future attention of a suitor. However, when the precious metal does experience another 10-15% pullback the quality, and especially more highly hedged players, will hold up better.

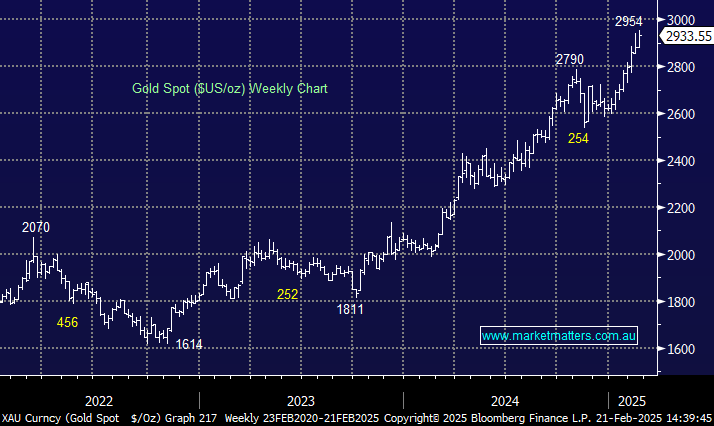

At this stage while we remain bullish toward gold medium-term, but we do believe a decent pullback is looming on the horizon hence from a buying perspective we would be patiently waiting to buy dips – they do happen, look at the banks this week!